Creativity drives costs lower and improves performanceThinking differently helps save money

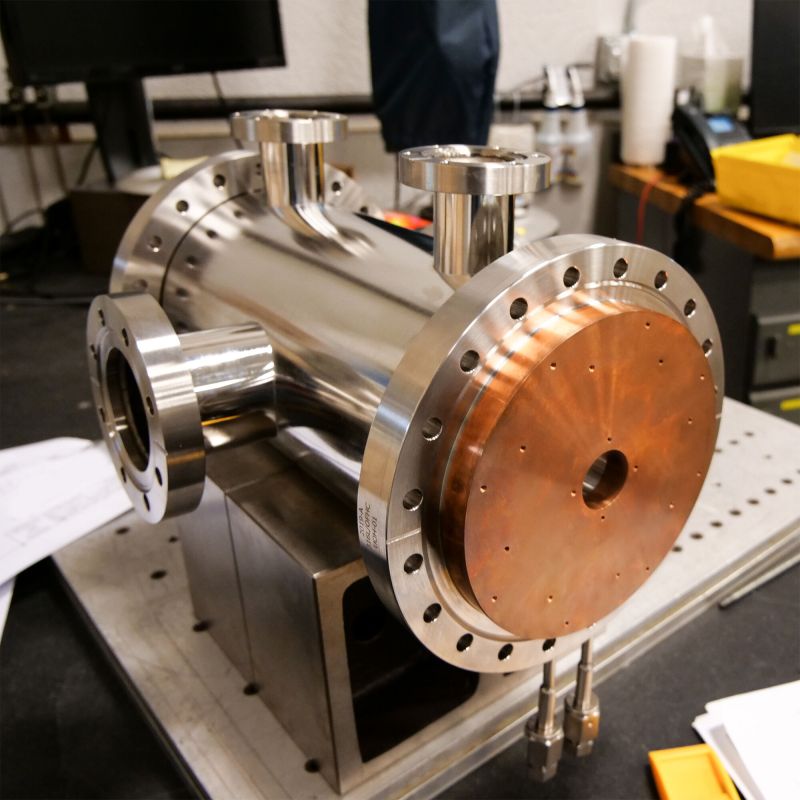

Visionary people look beyond what’s immediately in front of them and see opportunity. And in 1965, that’s exactly what Norman Vaudreuil did when he founded A&N Corporation, now known as ANCORP. The company makes high and ultra-high vacuum components. Think aerospace. Or complex industrial environments. And even companies that produce technology components. ANCORP supports all of these industries and many others.

ANCORP has evolved in many areas since its earliest days, and that includes its internal administration and employee benefits. While tough decisions are inevitable, the company has been unwavering in its focus on quality workmanship and service, and likewise has always focused on providing quality healthcare plans for its team members.

Costs are risingCHALLENGE: Employee insurance premiums are growing

ANCORP had a long-standing relationship with an independent advisor for their healthcare insurance. And predictably, annual plan renewals continued to see a steady increase in premiums while also showing a decline in available benefits. Year after year, only traditional carrier plans were submitted to company leadership, with limited creative thinking about a different approach.

The ANCORP CFO recognized it was time for a change, and took steps to take control and create an EMPLOYER-BUILT healthcare plan.

Think different about healthcareSOLUTION: Creative ideas lead to cost savings

Around 2021, ANCORP contacted Mark Fox – a Mitigate Partners advisor and founder of CBG Health – to explore new approaches to the issue of growing premiums and declining benefits. Mark and his team quickly reviewed the company’s plan history, and created a very innovative EMPLOYER-BUILT healthcare plan.

Starting with a voluntary custom plan built on a rented national network, the new ANCORP plan featured a vanishing deductible program where participants have ZERO out-of-pocket costs unlike a deductible or co-insurance under traditional plans. Additionally, the new plan includes a predictive claim detection component, that gives company leadership advance awareness of extraordinary potential claims that could create a significant unplanned liability.

And that feature was needed in just the second year of the plan. An employee was facing significant medical treatments after a cancer diagnosis, and the projected liability was around $800,000. While challenging on the surface, the expertise of the CBG Health team effectively eliminated that liability completely through pre-existing agreements with stop-loss coverage and specialized non-profit programs designed specifically for these situations.

A win-win-win for all parties – ANCORP, the stop-loss carrier, and most importantly, the employee patient.

Better care and lower costsRESULTS: Sales growth and improved productivity

The ANCORP EMPLOYER-BUILT plan is fairly new to the company and actual results for comparison will be forthcoming as more employees participate in the plan. Still, company officials have seen – and measured – a significant improvement in overall operating results, stemming largely from greater employee satisfaction that includes a better healthcare plan that helps both the employer and employees save money. Below is just one key metric.

EMPLOYEE PRODUCTIVITY: 32% GROWTH

ANCORP is now enjoying Healthcare that Works. Contact Mark Fox for more details about his approach to helping this employer think differently about healthcare.

- Client:

- ANCORP

- Year:

- 2021

- Location:

- Williston, FL

- Number of employees:

- 100

- Download Case Study:

- Click here