Karen scheduled a routine colonoscopy when she hit that magic age and her physician suggested she get that PREVENTIVE screening. With no family history of issues and no individual symptoms, she proceeded quickly to get the PREVENTIVE procedure accomplished. Scheduled and performed, the PREVENTIVE procedure yielded no negative results. Check that box. No surprises. Onward with life.

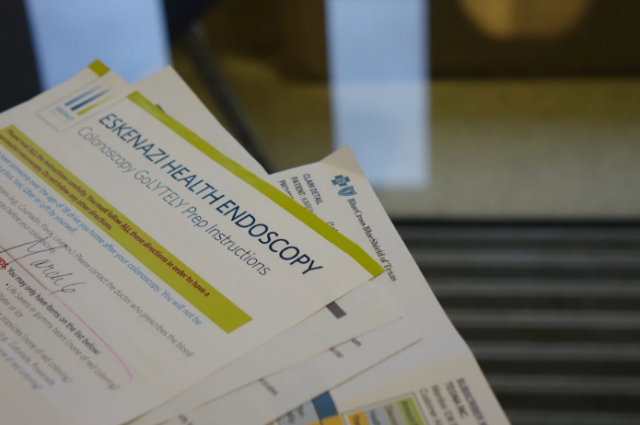

But there were surprises with the billing and her covered benefits under her employer-sponsored health insurance plan. PREVENTIVE screenings – mammograms, colonoscopies, cervical cancer checks – are covered under federal law (The Affordable Care Act) and are not supposed to cost patients anything out-of-pocket. But Karen was charged individually – $765 – to cover the gap between her insurance benefits and what was billed. In summary – the uncovered costs resulted from “extra” components not considered part of the procedure; in this case, the charges were for the recovery room and related staffing. Absurd to think recovery is separate and discretionary from the procedure itself, but therein is an example of the gray areas that give big insurance carriers latitude to decline claims and collect even more from individuals. And perhaps you already know the answer to the next question. Karen’s health insurance plan was thru Blue Cross Blue Shield of Texas … an affiliated organization of one of the largest private insurance companies in the country.

Read more about this story … click here. (Source: Healthcare Headlines: Her colonoscopy should cost her $0. Why was she asked to pay $765? – WVPE.org)

Read more about this story … click here. (Source: Healthcare Headlines: Her colonoscopy should cost her $0. Why was she asked to pay $765? – WVPE.org)

With health insurance plans from very large traditional providers, there is generally a bias to pay for as little as possible under the provisions of the plan. Why is that? It’s simple. Large insurance providers are businesses – publicly traded in most cases – and their objectives are to maximize revenues and grow profits. Drawing a hard line of interpretation on what is regulated and what is left to interpretation gives these carriers great leverage to collect above and beyond what is intended to be “zero additional cost” to the patient.

Does this sound like your employer-sponsored plan? Do you have full visibility into these details? Smart businesspeople – like you – are taking control and are reducing their exposure AND their costs by having more control over their employer-sponsored healthcare plan. You can too. Contact us today to learn how we can help.