Everyone knows that the cost of everything continues to grow. But in basic terms, that’s expected as wages grow … paying people more will drive the cost of the goods and services that people produce. One item that continues to grow rapidly is the cost of your group health plan … for both your business and your employees. But what is the real growth trend? Is it significant or just a storyline for news outlets? You decide.

Take a look.

In the past 10 years – the OVERALL annual cost of group plan family premiums has grown from almost $17,000 to over $25,000 – almost 50%.

- Plan sponsor (or employers) premium costs have grown from $12,000 to almost $20,000 per covered employee.

- Participant premium costs have grown from almost $5,000 to $6,300.

Plan deductibles have grown as well – from $2,600 to over $3,700.

What’s really interesting is that – while costs have grown for both employers and employees – employers are actually absorbing MORE of the premium costs over the past 10 years – from about 71% now up to over 75%.

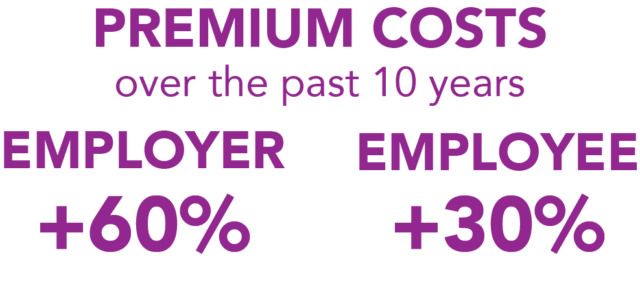

And the net result over the past 10 years?

- Plan participants are paying about 30% more for their group health plan.

- Plan sponsors (or employers) – are paying 60% more.

- Deductibles are now 42% higher.

For a 100-employee organization over the past 10 years:

- Employer costs are over $725,000 higher.

- Cumulative plan participant costs – including deductibles – are over $250,000 higher.

That’s almost a tidy $1 MILLION in higher total costs over the past 10 years – for healthcare “benefits”.

And what’s the real impact? A lot – much of which is very concerning.

- Employers are increasingly challenged with growth opportunities requiring investments because the cost of their group health plan continues to grow.

- Employees may or may not be healthier because of delaying medical treatments due to growing out-of-pocket costs, which can impact their performance, morale, and overall satisfaction.

Things to consider:

- How is employee wellness trending? Are more people sick or unable to come to work?

- What growth plans have you delayed in your business due to lack of capital?

- What office or technology upgrades have you delayed in your business?

- Is your benefits broker offering you more than one option for your plan?

- How often does your broker review your plan with you? Once a year? Ongoing?

If any of this describes your business, perhaps it’s time to think differently. Contact us today to learn how we can help you grow your business.